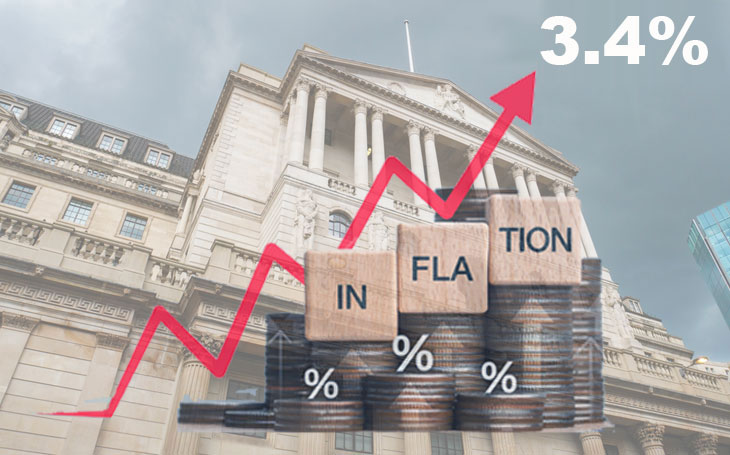

‘Disappointing’ December increase in inflation raises fresh questions over expected base rate cuts in 2026.

22nd Jan 20260 423 1 minute read Simon Cairnes

Government figures reveal inflation has risen for the first time in five months, climbing to 3.4% from 3.2% in November, which is well above the Bank of England’s 2% target.

The rise was driven by Chancellor Rachel Reeves’s increase in taxes on cigarettes and rising airfares, which leapt by 28.6% compared with a year ago. Food inflation was another contributing factor, climbing to 4.5% from 4.2% in November, adding to the cost of living and dampening consumer confidence.

Nicolas Crittenden, NIESR

Nicolas Crittenden, NIESR

Nicolas Crittenden, an Associate Economist at the National Institute of Economic and Social Research, told The Times: “Inflation is still expected to fall towards 2% this year due to weakening wage growth and energy prices stabilising from April onwards.”

It is why investors are still expecting the central bank to lower interest rates twice this year to 3.25% from 3.75%, having lowered them four times in 2025.

To witness inflation creep back upwards again will no doubt be disappointing for many.”

Nathan Emerson, CEO of Propertymark

Nathan Emerson, CEO of Propertymark

Nathan Emerson, CEO of Propertymark, says: “To witness inflation creep back upwards again will no doubt be disappointing for many consumers who will have been hoping to see a drop as we move further into the first quarter of 2026. With luck, this will prove to be a small blip in what has otherwise been a sustained downward trend over recent months.

“However, some lenders have already started to offer more competitive mortgage deals, which should help invigorate the housing market throughout the year, alongside the general improvement in mortgage availability that has recently been highlighted by the Bank of England.

“Should inflation continue to trend downward overall during the course of the year, we should start to see a more buoyant mortgage market, reflecting a greater degree of affordability not seen for some time. This would be very welcome news for anyone hoping to approach the buying and selling process.”

TagsInflation rate 22nd Jan 20260 423 1 minute read Simon Cairnes Share Facebook X LinkedIn Share via Email